Click here to get this post in PDF

A European country, an Asian country, a Middle Eastern country, a Balkan country, a Caucasian country, a Black Sea country, all-inclusive so to say. We are here to talk about the former Osman empire, currently known as Turkey, whose economy is (spoiler alert!) in tatters. The following material contains scenes of economic collapse – viewer discretion is advised.

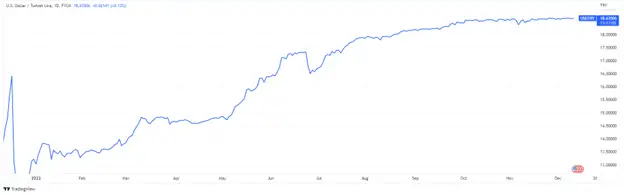

“Turkish Lira Hits New Record Low…” – how many times throughout the year have you seen this title? TRY has lost 30% year-to-date (YTD) against the US dollar due to the unconventional policy on addressing inflation utilized by CBRT. But we’ll get to that later. Let’s try to work out what’s happening.

The ongoing financial and economic crisis in Turkey started way back in 2018. It’s characterized by the lira plunging in value against most major global currencies, accelerating inflation, and rising borrowing costs. The crisis is guided by excessive account deficit, meaning the country imports more than it exports, has large amounts of private foreign-currency denominated debt, and of course, unorthodox ideas about interest rate policy set forth by the Turkish president. While rapidly growing economies use interest rate hikes to increase the cost of borrowing money and reduce economic activity, Turkey has been keeping its interest rate very low, putting the economy in a difficult position.

Investment inflows had already been declining in the period leading up to the crisis due to constant disagreements with the political establishments of Germany, France, and the Netherlands, which were accused of being involved in the 2016 coup attempt and whose assets were seized. Political instability in Turkey led to cutbacks in funding from foreign companies.

The Turkish lira started 2022 at around 13.35 against the US dollar and steadily declined in value through the year. Its rate fell to 18.63 in December.

Judging by the chart above, one may assume that the currency has stabilized since early October 2022. Not without reason – the country’s central bank adopted around 100 new regulations in the lead-up to the next-year elections. In order to stay up to date with regulator announcements, most traders follow the economic calendar, which gives an opportunity to be in the loop and prep for further market moves.

The skyrocketing prices have political implications for Erdoğan, as rising living costs have undermined public support for the president. And when we say skyrocketing, we actually mean it. You be the judge – inflation in Turkey has reached 85%, food prices are 99% higher, housing has increased by 85%, transport is up 117%, and the lira is significantly devalued. The lira’s fall has also impoverished northern Syria’s citizens, who use the Turkish currency for everyday transactions.

The value of the lira is weakening at a time of particular strength in the US dollar value.

Things are turning sour over the matter of rising prices for energy and other commodities driven by the Russia-Ukraine conflict leading to the cost of importing goods ticking upwards, which worsens inflation.

What will happen to the USD/TRY pair in the future? The ‘lira-ization’ of the economy launched by the central bank has stabilized the exchange rate. But in our opinion, this is a short-term fix as converting FX deposits to lira deposits and forcing the conversion of export earnings does not help with the divisive monetary policy which the central bank utilizes. With the account deficit growth and an inflation rate of over 80%, analysts anticipate further weakness in the value of the Turkish lira.

You may also like: Which Economic System is running in the USA? A Guide to How the US Economy works

Image source: Pixabay.com