Click here to get this post in PDF

Since February, Russia has been all over the media, and one could not fail to notice. The same can be said about its currency. At any rate, almost every person around the globe is aware of what’s been going on. Speaking of the rate, let’s take a look at the dollar-to-ruble pairing.

When diving into the history of the USD/RUB rate over the last ten years, one may notice a consistent pattern of price movements correlated with oil prices. It should come as no surprise because Russia is the world’s third-largest oil producer after the US and Saudi Arabia, and the largest oil exporter of petroleum products. Revenues from oil and gas sales are the largest source of income from foreign trade operations in Russia.

Following the events of February 2022, the US and its European allies imposed economic sanctions on Russia, including a price cap on Russian oil, which went live this month. Considering that Europe is heavily dependent on Russian energy and the main market for oil exports, these can be considered some of the most severe measures. The agreement states a maximum of $60 per barrel of Russian seaborne oil. However, some European countries, like Poland and the Baltic States (Estonia, Latvia and Lithuania), wanted to go after Russian income more aggressively by setting a much lower price cap.

When it comes to practice, it is important to realize that the ban applies not so much to the purchase of oil and petroleum products in Russia as it does to their insurance and transportation by sea. The reason the US and its partners think it could work is that Russia wouldn’t be able to find an alternative to London insurers and Greek ships very easily.

In retaliation, Russia refused to supply oil to the countries that supported the price cap, refocusing on partners that adhere to the market pricing policy. Russia has seen an increase in demand from Asian countries, notably India and China, due to the market discounts on Russian crude. The Bank of Russia’s trade statistics revealed that the value of Russian exports in the first nine months of 2022 exceeded the value from the corresponding period a year ago. Not to lose track of events affecting the market, which this year have been enough to sink a battleship, most traders use an economic calendar.

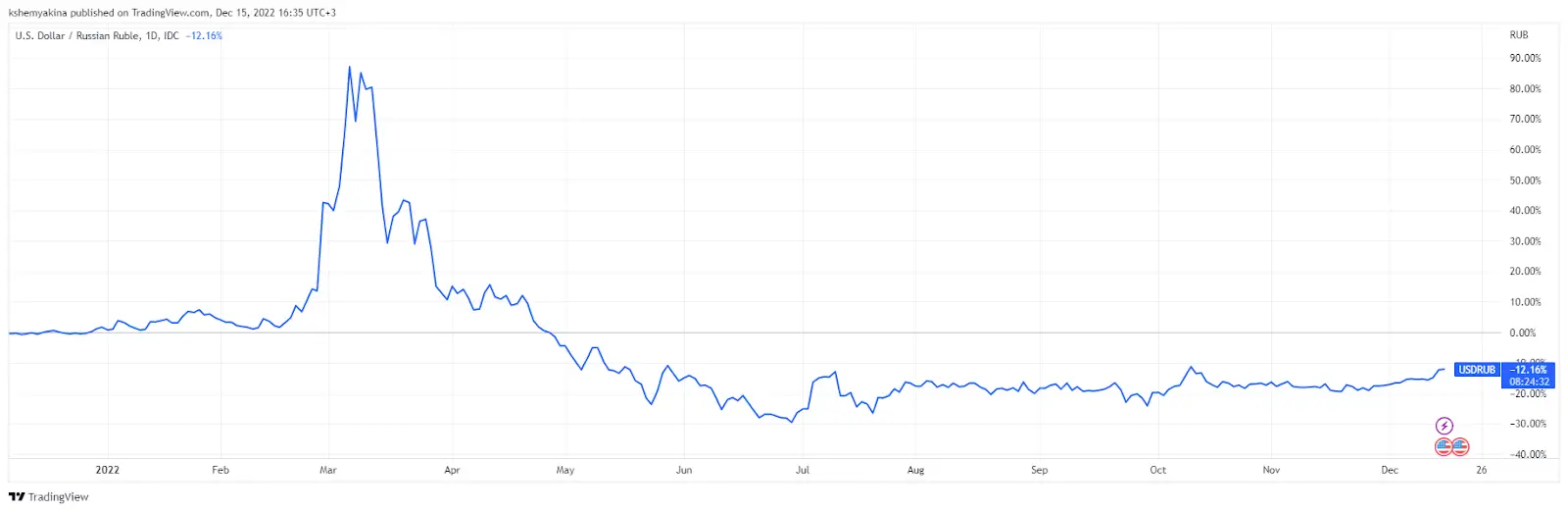

Despite the sanctions placed on Russia by the West, the ruble managed to become one of the top-performing currencies around the globe. The USD/RUB pair has been volatile over the year. USD/RUB rates surged over 36% in February 2022, reaching their highest-ever of 154 in March. The Russian government imposed capital controls to protect its currency, which led to USD/RUB rates retreating, followed by the USD falling by more than 20% against the RUB. Currently, the loss is around 13%.

Unlike most of the currencies that were severely hit by the Fed’s aggressive rate hikes, Russia’s emergency measures managed to shelter its economy from blows. Demand to pay for imports in the Russian national currency has also created extra demand for ruble. Some may call the Russian currency strength artificial. That may be true, but the outcome is the same as long as it is stabilizing its economy.

What’s to expect from this dynamic duo next year? The EU ban on Russian crude oil and refined products coming into force will definitely have its effect. Even though there are buyers willing to pick up discounted Russian oil, they will most likely confront restrictions, the logical conclusion of which is Russian oil supply falling over the course of 2023. This will backfire not only on Russia, but will lead to the whole oil market being tighter.

The Bank of Russia forecasted a recession in the country and expected positive GDP growth to start from the second half of 2023 at the earliest. The long-term dollar to ruble forecast says that in the same period next year, USD/RUB is expected to trade at above 80 and get back to 60 by 2025 at the earliest.

We ask you not to take this market analysis as a call for action. Forecasts can be wrong, and before stepping into a trade, you should always conduct your own research. This is rule # 1, and it must never be forgotten.

Disclaimer:This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading/investing experience.

You may also like: How Foreign Currency Reserves Can Help Combat The Global Economic Crisis

Image source: Depositphotos.com