Click here to get this post in PDF

In real life, fixed prices might turn into rising prices in the stock market. A case in point is Dollar Tree, an American multi-price-point chain of discount variety stores. Listed on the Nasdaq Composite, the discount store fares much better within the given scenario than the aforementioned index. So let’s try to find out why the Nasdaq is coming up short and what to expect from Dollar Tree in the long run.

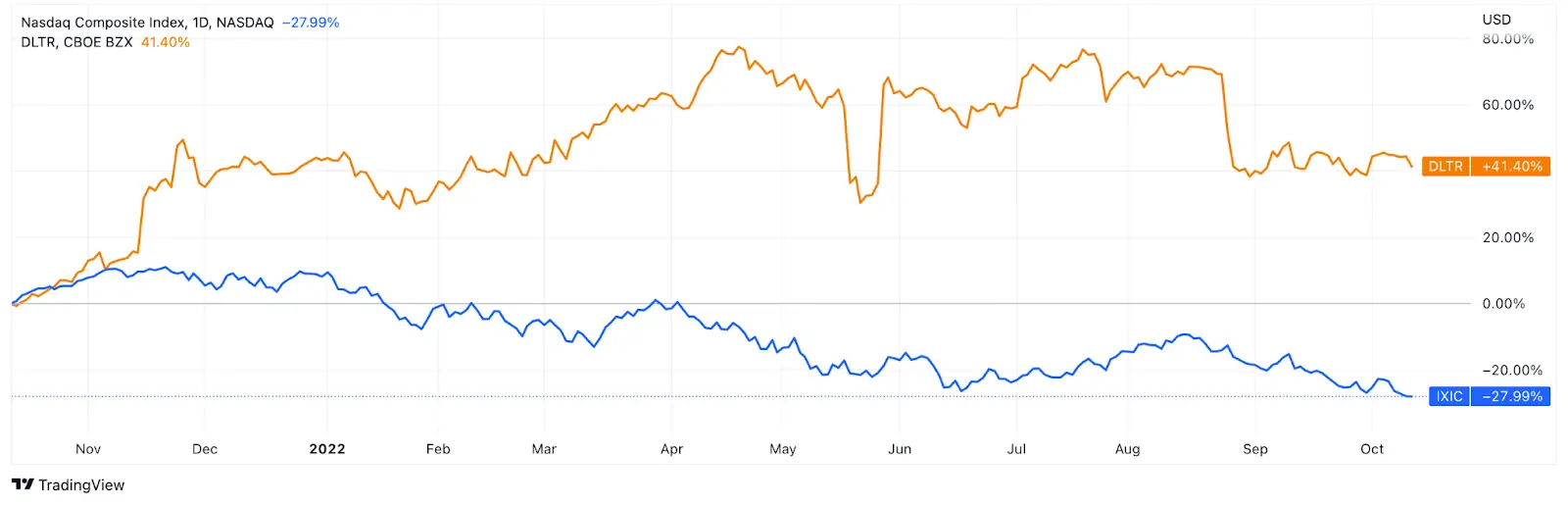

Over the last year or so, the Nasdaq has been going downhill along with the global markets, down over 33% for 2022 – so far.

We can see on the chart that the index closed 2021 with a positive outcome and showed promise at the start of 2022 as the effects of Covid-19 wound down. Lockdowns were lifted, air travel was resuming its natural course, goods delivery was back on track, cafes and restaurants opened – nothing foreshadowed trouble.

Sadly, it was destined to last. We woke up one day to news of a military conflict between Russia and Ukraine. In case you were wondering how to blight hope for a brighter future, here is the answer – an energy crisis that impacts the entire globe.

This is translated into inflation accelerating at unprecedented rates. In the summer of 2022, the US inflation rate reached a 40-year high of 8.6%, and the Fed started steadily hiking interest rates to try and cope with the escalation – and every one of those hikes hit the market.

However, things could have been worse. Many experts believe US indices were overvalued even before Covid hit, and many still are today.

Under such conditions, Dollar Tree stock shows remarkable growth of about 40%. On the following chart, you can see the difference more clearly. Dollar Tree outperforms the Nasdaq by more than 65%.

One of the possible reasons for such an impressive increase is inflation. Who would have thought it could be a boon to some businesses? Fixed prices are friends to people who try to spend less money on essential supplies. Moreover, more and more people were visiting discount stores as the present-day situation necessitated cutting back on spending.

So, Dollar Tree makes the most of the spotlight, developing its businesses and increasing its store count. Added to that, the holiday season is coming, prompting the brand to hire even more employees to satisfy demand. And one should not forget about the end-of-year gift from the stock market, aka Santa Claus rally.

But inflation is far more of a foe than a friend. Increasing operating expenses makes fixed prices far less fixed. Dollar Tree ups the price of most of its $1 items to $1.25.

Soon after, Dollar Tree decreased its earnings per share forecast.

Experts worldwide think that Dollar Tree stocks will show positive dynamics in the 12-month term, with the average target price being about 20% higher than its current actual price. But as you can see, the pros and cons of these stocks consist of multiple pages, so always do your research before deciding to buy, sell or hold your asset.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading/investing experience.

You may also like: What Entry-level Investors Must Know About the Stock Market

Image source:: Shutterstock.com