Click here to get this post in PDF

With Radiant, users will be able to deposit any major asset on any major chain and borrow a range of supported assets across many chains. Radiant intends to be the first omnichain money market.

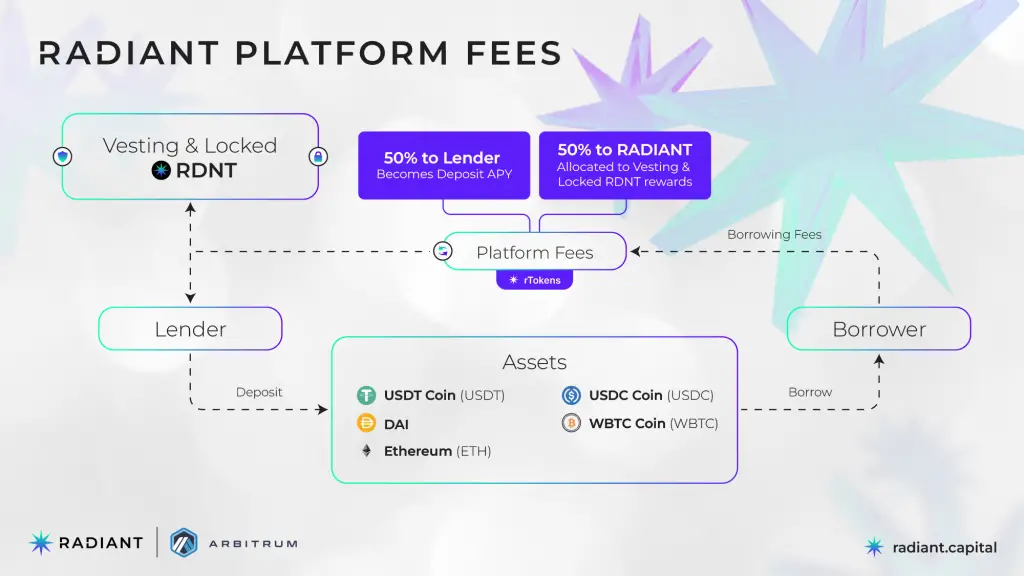

Interacting lenders who supply liquidity to Radiant are useful to the platform. Through the native token $RDNT, lenders can profit from the engagement of the communities.

Check RDNT Token Price (Radiant Capital)

2022 was a bad year for RDNT and crypto. But now in 2023, RDNT has a good rally, expecting better performance.

At the time of writing, the current RDNT price is $0.25 per coin. The 24-hour trading volume for the coin is $15,496,322.

why you should use radiant capital (RDNT)

In the past, getting a loan required you to visit a bank or other financial institution, have a large amount of cash on hand, and offer collateral. Radiant eliminates middlemen from savings accounts, futures contracts, and asset trading. The native utility token $RDNT is used by the Radiant DAO.

what is RDNT?

The native utility token of Radiant is the ERC-20 RDNT, with emissions distributed to users that use the network as Lenders, Borrowers, and RDNT/WETH Liquidity providers.

Users can obtain the extra value from the communities’ involvement through the native utility token $RDNT from borrowers and platform fees by interacting and offering utility to the platform.

Emissions from liquidity mining must be vested over a period of four weeks (28 days), however they can be claimed right away with a 50% penalty. Then, those that opt to lock RDNT for 28 days receive this penalty cost. By locking their tokens, this approach rewards Radiant DAO participants who actively support the protocol.

RDNT Token Allocation

RDNT has a total supply of 1,000,000,000 tokens.

- 50% of the emission is released over a two-year period as incentives for suppliers and borrowers

- 10% of the team allocation is locked at protocol genesis and unlocks at the three month cliff. 20% to the team, released linearly over a year, with a three month cliff.

- 3% reserved for the Treasury & LP.

- Core donors and advisors received 7% of the budget. These come out in a linear fashion throughout a year.

- 20% released over a two-year period as rewards for Pool 2 liquidity providers.

It is advisable to thoroughly evaluate the current market trends, pertinent news, technical and fundamental research, and experts’ opinions before investing in cryptocurrencies. Keep in mind that past performance does not guarantee future outcomes. Additionally, be sure you never invest anything you wouldn’t be willing to lose.

You may also like: CoinsPayWorld.com Review: How to Pick the Best Crypto Exchange for Cryptocurrency Trading?