Click here to get this post in PDF

Merck is one of the biggest pharmaceutical companies in the world and one of the leaders in the Dow Jones Industrial index. In fact, Merck stock has had such a good year that it’s outperformed the Dow Jones by about 30% over the year so far. Moreover, it looks like the growth will keep coming, in stark comparison to the overall bearish sentiment around DJI.

How is that possible, you may ask? Well, the Dow Jones can be seen as a snapshot of what’s going on with major US companies – so when the world goes through a long-term economic crisis and most companies fall to shambles (sound familiar?), the Dow reflects that.

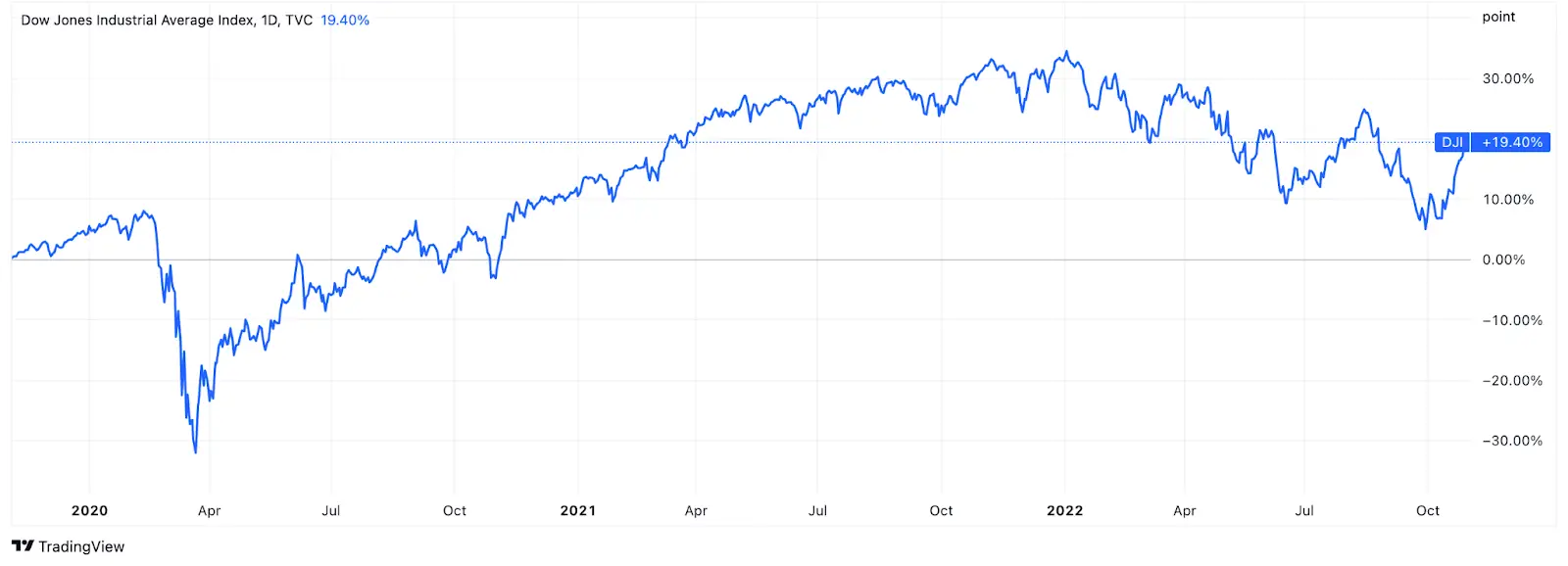

Let’s take a look at how the Dow Jones Index has performed over the last three years, starting back in 2020 when Covid-19 made its entrance, causing a dramatic drop in the immediate before giving way to a gradual bull market that lasted all the way until February 2022.

The pandemic boom, which saw many brands rake in the cash by embracing an online business model, is now well and truly over after the events of 2022. The military conflict in Ukraine quickly led to an all-encompassing energy crisis, accompanied by surging consumer prices and accelerating global inflation. Central banks around the world began hiking rates to tame inflation, with the hawkish Federal Reserve aggressively hiking interest rates in the US, with each hike aggravating the stock market.

Merck stock is listed on the DJI, but when looking at the chart it almost seems like the company is completely unaware of the global slump. The pharmaceutical giant has seen +13% over the last 12 months, or +17% if we count the dividend yield.

Merck made its name developing and producing medicines, vaccines, biological therapies and animal health products, and is now one of the biggest blue chip stocks in the US – a company is often considered blue chip when it has a strong brand name and presence, as well as financially sound fundamentals and consistently strong earnings.

Besides, Merck belongs to the dividend aristocrats of the market. These are public companies that have not only paid but raised dividends every year for decades, and not only does Merck fit into this class but its dividend yield is 2.96% when the average dividend from companies listed on the Dow is 2.01%.

The pharmaceutical giant has an important growth engine called Keytruda, which is a medicine used in cancer immunotherapy to treat certain types of the disease. In addition to its primary role as a cure for cancer, this segment also provides a lucrative business for the company itself – for the first half of 2022, Keytruda made up about one-third of all company sales, representing more than $10 billion.

However, for Merck, more than just Keytruda holds potential. Cancer treatment is one of the company’s main priorities and a promising direction for future development, which, of course, comes with pros and cons. On the one hand, this focus is almost guaranteed to bring in promising returns (if the treatment’s success continues); on the other hand, such odds could result in Merck not being sufficiently diversified.

Perhaps one of the reasons the diversification factor doesn’t seem to bother investors is that it’s not actually an issue right now. Merck specializes in a ton of fields and works in a variety of areas, ranging from biological therapies to the production of animal health products. On top of that, Merck has a patent on Keytruda until 2028, so there are still years of sales in their future.

One more factor leading to bullishness around this stock is its price-earnings ratio, which is sitting at about 16 right now, meaning there is still growth potential here –sentiment analysts agree with, on the whole. In addition, MRK’s average price target is around 7% higher than its current share price, which may not seem like a huge upside, but given the overall economic crises and when you consider how many stocks have negative price targets, you can see why Merck stands out.

Meanwhile, analysts still believe the overall market is overvalued and could continue to see losses, meaning the gap between the Dow Jones and Merck may only widen. That being said, analysts don’t always know everything, so make sure to do your own research before making a trade.

You may also like: What Entry-level Investors Must Know About the Stock Market