Click here to get this post in PDF

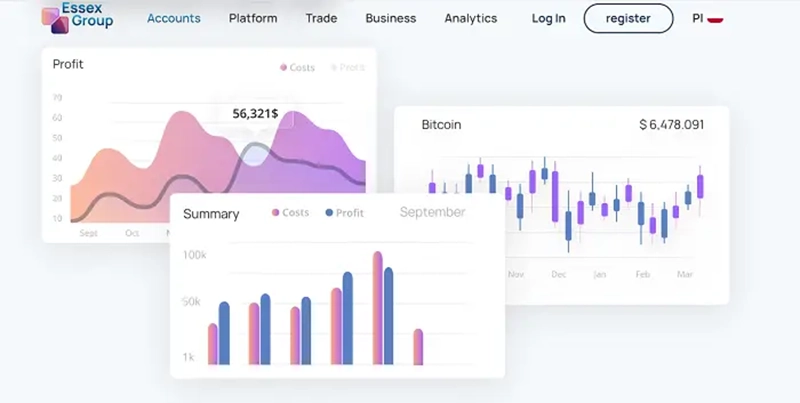

Image source: essexg.com

The cryptocurrency environment is projected to shift by 2024, according to conjecture. As the bitcoin industry grows, Trading platforms will give investors a reliable and uninterrupted trading experience. This study examines the expected features and functionalities of trading platforms in 2024 and how they will empower traders in the ever-changing cryptocurrency market.

1. Combining several machine learning and AI methods

Advanced trading systems may utilize AI and ML to boost predictive analytics in 2024. These tools can analyze massive databases, identify patterns, and accurately predict market trends. Traders using AI-driven analytics tools may get insights to make better judgments.

Cryptocurrency trading automation is expected to grow in 2024. Essex Group may feature advanced capabilities for automated trading techniques. Algorithmic trading uses predefined rules and conditions to execute deals in response to market signals automatically. Trading experts might profit from increased efficiency and real-time market possibilities.

Artificial intelligence and machine learning can improve trading platform risk management systems. These technologies can continually assess risk factors, alter trading settings, and advise portfolio changes to decrease loss risk. Traders will have better risk management, making trading safer.

2. Compliance with regulations via enhanced security

Cryptocurrency trading platforms prioritize security. Multi-layered security mechanisms are expected on platforms by 2024. These protocols may incorporate biometric authentication, decentralized identity verification, and increased encryption. This improved protection protects users’ assets and sensitive data from growing cyber threats.

Cryptocurrency regulation is changing globally. In response, trading platforms are expected to interact more smoothly with regulatory norms. This may involve stricter KYC checks, transaction monitoring, and country-specific restrictions. Regulatory-compliant systems are likely to gain customer confidence.

Essex Group may use cold wallet storage to secure their funds. Offline cold wallets are more secure against hacking attempts. In 2024, platforms like Essex Group may prioritize digital asset storage, boosting trader trust.

3. Increased asset offerings and market integration sophistication

As the bitcoin business grows, trading platforms may provide more than cryptocurrencies. These platforms may include tokenized real estate, stocks, and commodities. These diversifications allow traders to explore more investment alternatives on one platform.

Trading platforms may integrate further with traditional financial markets in 2024. This is (b) deeper market integration. Partnerships with existing exchanges may allow people to trade cryptocurrency and conventional assets in one transaction. The convergence of traditional banking and cryptocurrencies may create a more integrated and accessible global economy.

Essex Group may help integrate DeFi services as DeFi grows. This might include decentralized lending, borrowing, and yield farming. All these operations might happen on the trading platform. A more comprehensive financial ecosystem that blurs traditional finance and decentralized capitalism may benefit traders.

They expect that bitcoin trading will change significantly in 2024. Technology, security, and new trends will drive this change. Trading systems will evolve to fulfill investors’ growing needs. These platforms will include AI-powered tools, solid security, and more assets to trade. Platforms like Essex Group will give users the tools and features they need to navigate this dynamic and growing environment, which will shape the future of cryptocurrency trading. In 2024 and beyond, traders who can adapt to these developments and utilize current trading platforms will benefit from a more efficient, secure, and integrated cryptocurrency trading experience.

Disclaimer

The information contained above is provided for information purposes only. The contents of this article are not intended to amount to advice and you should not rely on any of the contents of this article. Professional advice should be obtained before taking or refraining from taking any action as a result of the contents of this article. Sandra Hinshelwood disclaims all liability and responsibility arising from any reliance placed on any of the contents of this article.

You may also like: