Click here to get this post in PDF

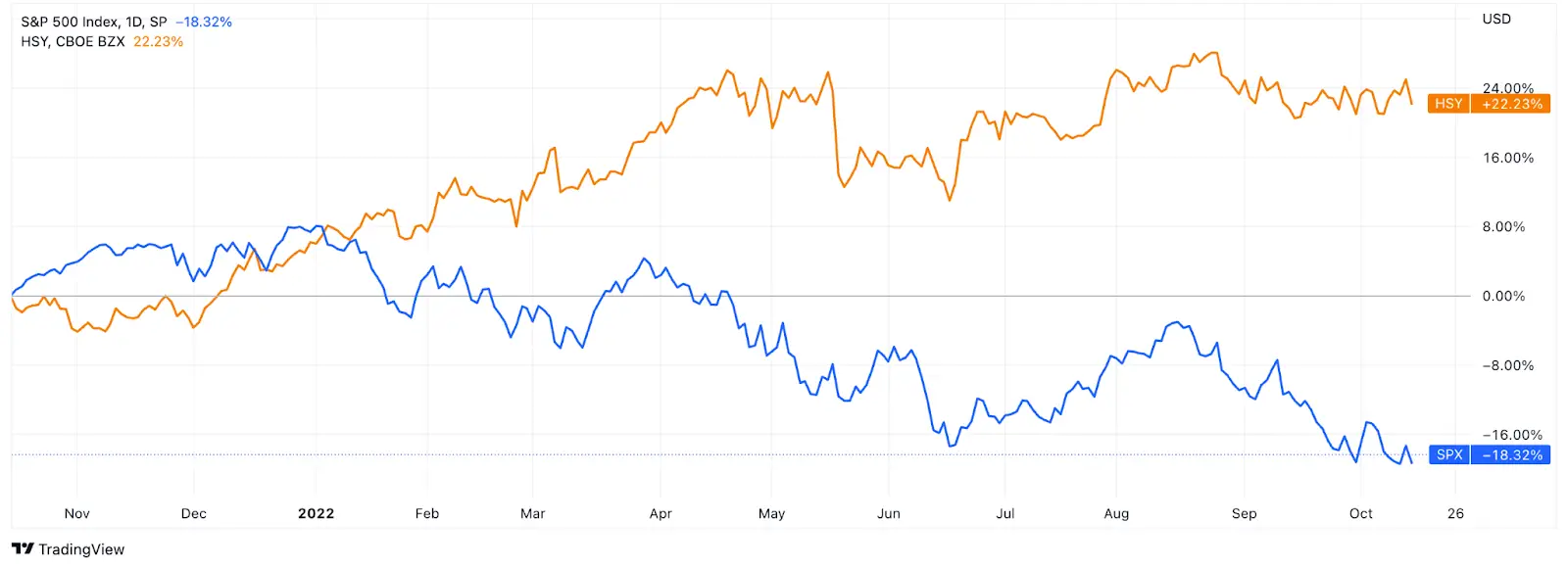

Who doesn’t like chocolate? Well, if not chocolate, then salty snacks or pouring tons of syrup on their morning pancakes. What could afford more pleasure? When all of these threats help us make money. If you’re still wondering what we’re talking about, we are referring to the Hershey Company. Its stock has outperformed S&P 500 (the index it is listed on) by more than 40% over this year so far, and in this article, we will talk about why that happened and what might happen next.

S&P 500 is a market index listing the 500 major American companies. Pretty much all of these companies have fared poorly throughout 2022, the S&P 500 Index has lost 18% over the last year.

Back in January, when pandemic restrictions were being lifted one by one and economies around the globe started to rebound from the fallout caused by COVID-19, it looked like S&P 500 had the potential for a prosperous 2022.

But, in February 2022, it all went south. The military conflict between Russia and Ukraine destroyed hopes for a post-pandemic recovery.

The conflict caused an unprecedented energy crisis, followed by widespread supply disruptions. As a result, we get global inflation, and this energy crunch exacerbated that in a big way. The US is no exception here – in summer 2022 inflation in the region level 8.6%, making it a 40-year record.

So, the Fed did what it does best: it began hiking interest rates, and every one of those hikes just adds insult to injury.

While markets are in the turbulence zone, which seems to know no edge, Hershey stock takes an upturn.

The following chart is a comparison between Hershey and S&P 500. Needless to say, how big the difference is. You can see it yourself.

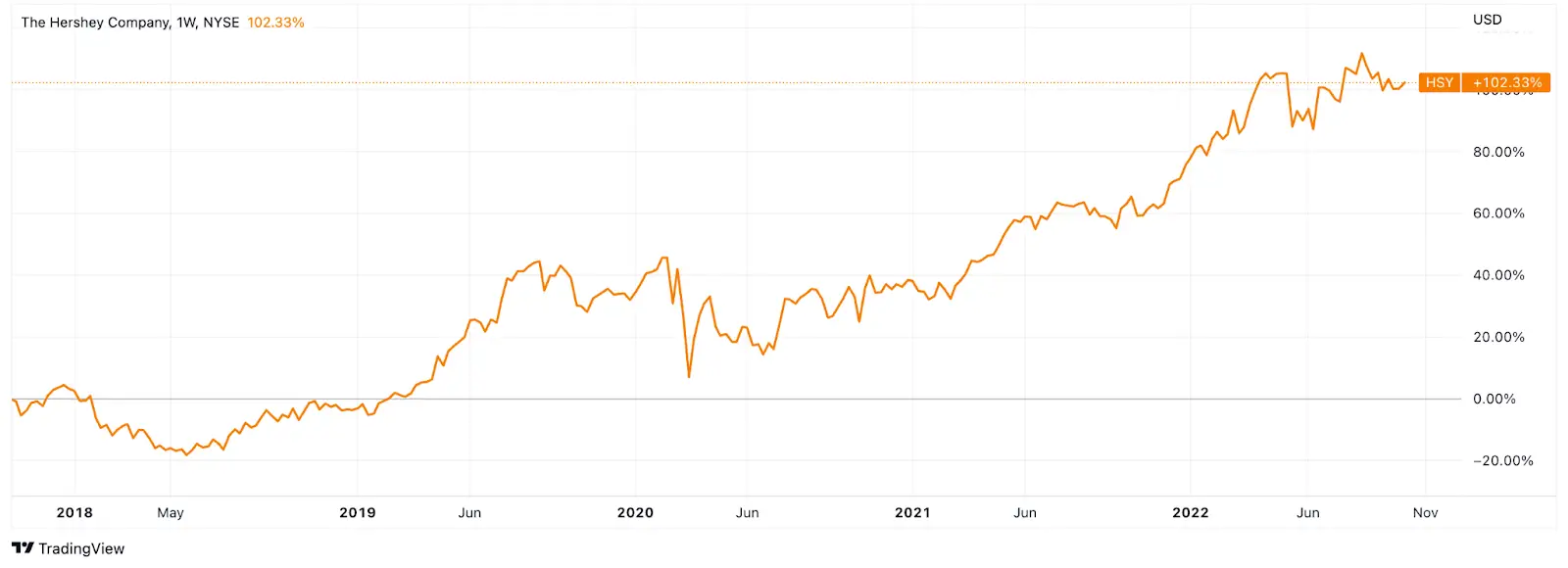

This growth did not occur only in the last 12 months. Let’s look at the changes in Hershey over the last five years.

The value increased by over 100% in that time. Looks like people are obsessed with Hershey’s. Which is fair; it’s delicious, let’s be honest. It’s not only about that. The explanation might be a bit more complex.

Hershey Co. engages in the manufacturing and marketing of products that are chocolate or candy based. Its brands include famous names like Hershey’s chocolate itself, Reese’s and Kisses, as well as some lesser-known names.

The brand strength gives Hershey an opportunity to raise the price of its products to cross-effect an economic downfall. At the same time, the company also increased the number of sales points, cut the costs of cacao while inflation broke loose, ramped up production, and added new sales units like salted snacks.

The decisions made by Hershey’s management permit the company to enlarge its profit margins for 10 more years from 22.9% at the end of 2021. Hershey is a dividend growth non-cyclical stock, and its business doesn’t depend on seasons, which is a bonus for investors.

But every rose has a few thorns. Hershey’s P/E is sitting at about 29 – which is pretty high – and that might be an inhibiting factor for the future rise of its stock price.

There are spots even in the sun. Hershey’s P/E is sitting at about 29 – which is pretty high – and that might be an inhibiting factor for the future rise of its stock price.

However, the general forecast for Hershey by analysts around the world is +4.5% for the next 12 months – and don’t forget about the tasty dividends. More important than the tempting taste of chocolate and gains, though, is to make sure you conduct your own analysis before adding this or any other stock to your portfolio.

You may also like: 9 Unfamiliar Forex Trading Techniques

Image source: Shutterstock.com