Click here to get this post in PDF

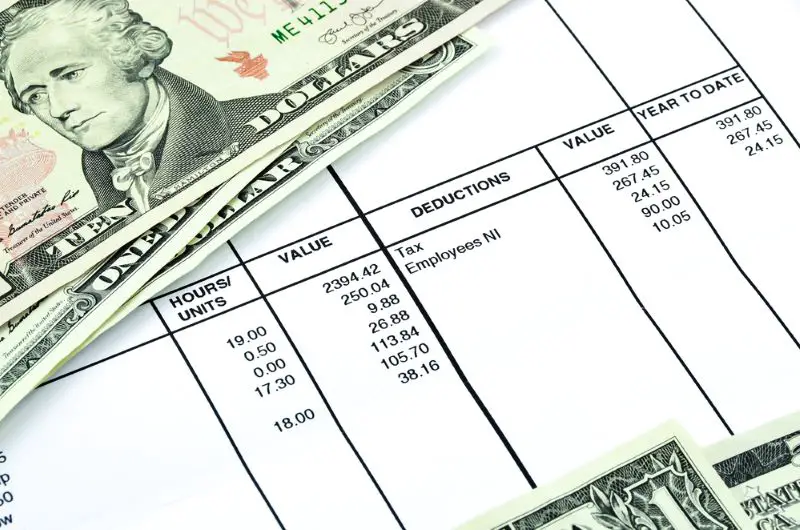

When employees receive their pay stub, they can check that the hours they have worked and the rate of pay is correct. Paystubs also show deductions for various benefits such as health insurance, life insurance, union dues and retirement fund contributions. These deductions may vary from employee to employee and depend on the number of hours worked or salary rate. Paystub maker is great because an employer can provide access to all kinds of information about their employee on the go without having to wait for long paperwork to be sent. However, there’s a different subset of information that isn’t mandatory but is recommended (like benefit deductions).

In this article, we’ll go over how to list benefit deductions on an employee pay statement.

Why List Benefit Deductions on a Pay Statement

The reasoning behind why you would want to list those deductions is simple.

Firstly, it keeps employees happier.

Many employees don’t take into account their benefits when they look at their overall pay package. So if their salary is slightly less than the market rate, then they may grow disgruntled and dissatisfied with their salary.

However, if they have better benefits than that which is standard in the industry, then their overall pay package is equal to if not better than their peers at other companies. But because they’re not conscious of that, they’re dissatisfied and may leave your company for opportunities elsewhere.

By showing an itemized list of benefit deductions on a pay statement, you can directly show your employees the value that they are receiving from their benefits every single payday.

This keeps their overall pay package at the forefront of employees’ minds, rather than just the number they see on their pay stub.

How to List Benefit Deductions

Now that you understand the why, let’s take a closer look at the how. If you’re like most companies, then you’ve got a whole array of possible benefits that employees can choose to enroll in.

The impact of that is that it would scarcely be possible for you to be able to list the full notation of all of those benefits on each paystub without making it far too long to be convenient. To mitigate this issue, a lot of companies will set specific acronyms for each benefit. Then, those acronyms are listed on the pay stub, along with the relative amount deducted for that benefit.

Leverage the Right Software

Not all pay stub software will have the capacity to list benefit deductions on their pay stub. That’s why it’s imperative that you choose a tool like PayStubs.net to be your pay stub software of choice.

Look at it this way: any time that you have to spend manually entering in benefit info into employee pay stubs is wasted. That time could instead be spent on revenue-generating activities that will grow your benefit. Thus, the opportunity cost of not having the right pay stub software is too high to ignore.

Wrapping Up

Now that you know how to list benefit deductions on employee pay statements, it’s time for you to figure out what acronyms you want to code your benefits by. Then, pick the right software to list those deductions on the pay statement and voila! You’re all done.

For more business advice, be sure to check out the rest of the articles on our website!

You may also like: Small Business Guide to Overlooked & Uncommon Tax Deductions

Image source: Depositphotos.com