Click here to get this post in PDF

The Australian dollar is terribly powerful. You never know which murderous spider could hide on the banknote’s other side. And this fact makes the AUD stronger, but not the strongest. Here, the USD is the king of 2022. The American dollar has increased against most of the world currencies, including the Aussie. However, next year might change the balance of power in the AUD/USD pair — let’s find out why.

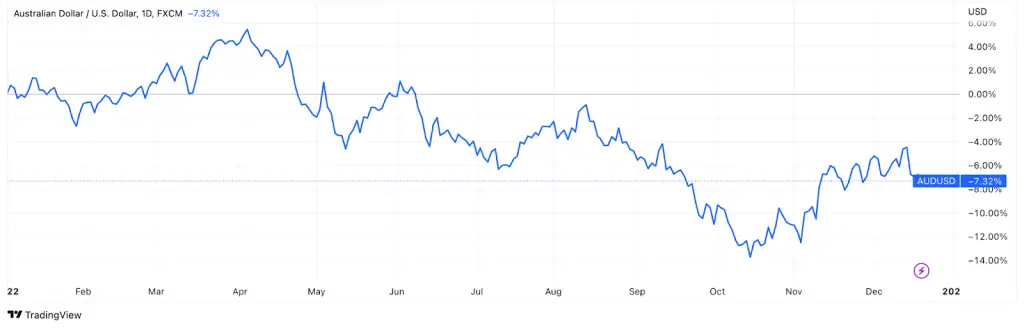

Since the beginning of 2022, the USD has increased against the AUD by 7%. But this number doesn’t reflect the situation during the year — the AUD/USD pair has actually been pretty volatile. In spring, the AUD was hiking against the dollar. In the autumn, however, it saw some pretty large drops.

There are several reasons for the US dollar showing such impressive results in relation to the whole world. The first is the Fed’s policy. The Federal Reserve has hiked the interest rate seven times over the course of 2022. Every increase has made the USD more attractive for investors. And every increase gave traders options to get profit. To monitor different economic events like this, you can use economic calendar.

The second reason is the permacrisis seen all over the world. Prices are rising daily, the global geopolitical situation is unstable, and local currencies don’t seem secure anymore — the US dollar has become the obvious choice for people in many countries. This increasing demand becomes yet another factor supporting the USD price.

At the same time, the Reserve Bank of Australia has been active in 2022 too. The key rate has been increased from 0.1% to 3.1%. In addition, at the end of the year, there were rumors that the Fed would stop its hawkish policy in 2023 — this tipped the balance in the AUD/USD pair, giving the Australian dollar an opportunity to grow against the American one.

Plus, the important factor for Australia is Covid-19 restrictions in China. Many experts consider that in the next year, the covid situation might ease up, and it will increase the volume of Chinese imports. So China is a key direction for Australian export. This is another factor supporting the Australian dollar.

As a result, the AUD has performed better than many other major currencies. For example, it has surpassed the Japanese yen and the British pound — it’s also been almost equal to the New Zealand dollar and the euro.

There is a high chance that next year won’t be so kind to USD. Instead, the Fed probably will behave more shyly — especially in the second half of 2023 — which would allow many currencies to increase against the US dollar.

The nuance distinguishing the AUD from many other currencies is the Reserve Bank of Australia’s policy in 2022. It has been rapid. Therefore, in 2023 the RBA might follow suit and make fewer drastic moves.

If these two central banks behave like doppelgangers, we can expect the ratio not to change too drastically in 2023. Significant movements are supposed to depend on the realization of different events, like the interest rate hike or China’s Covid-19 policy, as opposed to general patterns.

You may also like: How New Investors Can Invest in Stock Dividends

Image source: Depositphotos.com